5 reasons to look beyond the Net Promoter Score

Since its unveiling by Reichheld in 2003, the Net Promoter Score has been a phenomenally important innovation. No single development has done more to make Customer Experience a C-Suite issue, and to legitimise corporate investment in it.

NPS has been promoted as fast and simple way to measure and manage customer loyalty. It avoids the historic deficiencies of traditional satisfaction customer surveys that are often long, complex and unrepresentative.

Whilst most senior executives implicitly understood the potential economic value of customer loyalty and the importance of customer centricity, few took traditional customer satisfaction surveys seriously because their results correlated poorly with business performance and their findings were difficult to work with. They did not enable organisations to answer the questions “What’s going on and where should we act to try and make difference?” and “Will it be worth it if we do?”

By contrast, the NPS promise is very seductive. Its proponents say that NPS is a simple, cheap, easily deployed and easily understood measure. That it is robust and versatile, and provides actionable insight that has helped companies improve execution and their overall customer experience.

NPS gave teeth to customer metrics. It enabled organisations to quantify the economic answers to questions such as: What is the value of customer loyalty? What is the value of moving a customer from being a passive to a promoter? What is the value of increasing an NPS score by 10 points?

However, dig a little deeper and some of the NPS assertions are not so strong. Whilst the proponents and opponents of NPS are fairly equally ranged (http://www.genroe.com/blog/net-promoter-score-research-the-for-and-against-list/779), there is no doubt that it does have its limitations, that customer behaviour has changed, and that the ability of organisations to gather, mine, analyse and use customer data has moved on extraordinarily since 2003.

1) One number is not enough

The one question approach of NPS is beguiling in its simplicity but the truth is that there is no single customer metric that will provide an organisation with all the answers it needs.

A wide range of customer centric metrics are available and each has its specific strengths. Smart organisations will take a dashboard approach to their choice and use, and will also continue to explore both their customers and their data to identify new metrics

2) Different sectors and different customers are… different

NPS has been found to be challenging to apply on a universal basis. It cannot be used in all industries and in all purchase decisions. It struggles in sectors where there is low customer engagement (e.g. Utilities) or where that the purchase activity is fleeting and very transactional (e.g. Confectionary)

In addition, overall customer engagement and satisfaction with the sector can cloud the scoring of individual businesses. The 2014 Temkin Net Promoter Score Benchmark Study reveals that TV Service Provider, Ultility and ISP sectors all have poor NPS scores with relatively narrow ranges. This scoring belies the actual variations in growth and performance exhibited by the component organisations.

3) Social Media exploded after NPS came about

The ‘elders’ of Social Media: MySpace, LinkedIn and Facebook were all launched in or after 2003. In 2013, it was estimated that 25% of the world’s population (1.8 billion) were then using Social Media and that penetration was growing at 20% p.a. This is a world away from the one in which the original NPS Harvard Business Review article was published.

In 2003, it was assumed that most promoters and detractors had equal power. The plethora of available Social Media platforms and the widely varying behaviours and influence of users has put paid to this assumption. A single detractor or promoter can wield power over a business like never before.

4) Advocates are much more valuable than Promoters

Before Social Media, measurement of the Customer Experience was a relatively linear activity that followed the Customer Journey. However, businesses now need to factor in what, how and to whom customers communicate after their experiences.

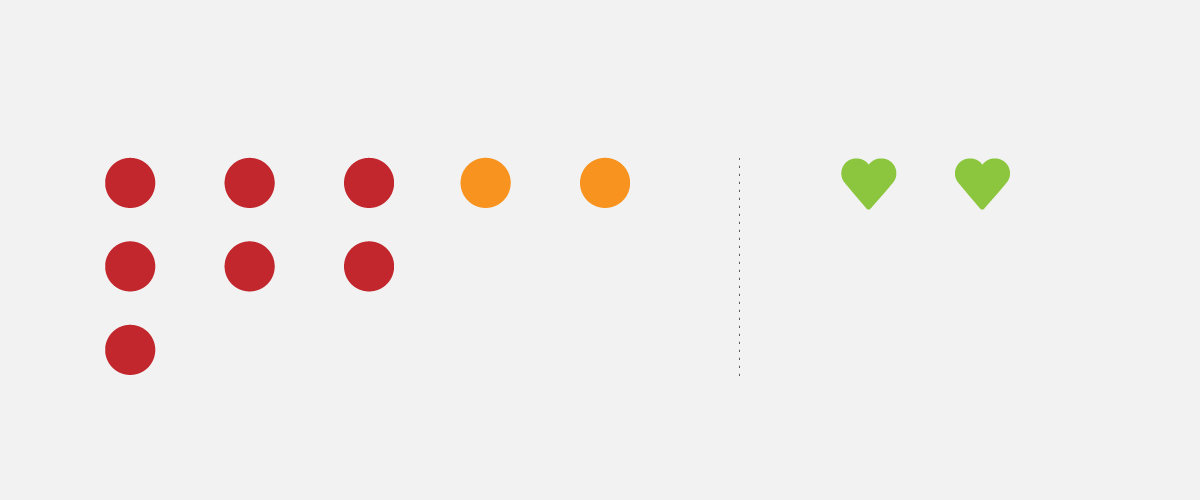

Whilst a Promoter is defined as a person who scores 9 or 10 in an NPS survey, Advocates are those customers who are actually out in the market advocating your business or brand. These are people who are demonstrably valuable – not just those who score one or two points higher than a Positive. Thus, the advocacy measurement captures the influence a customer has in addition to their consumption, loyalty and satisfaction.

A wide range of key figures and organisations including Philip Kotler, McKinsey, IBM and – tellingly – Bain & Co. (one of the developers of NPS), have all stated that the identification, development and measurement of advocacy is a key next step in the further improvement of customer centricity and business performance.

5) Customer metrics might have a new emperor

Perhaps the current pinnacle of customer metrics is the individual Customer Health Score. Taking all the learnings from the development of quality measurements onwards, Customer Health Scores harness the much improved data acquisition, customer insight and analytics capabilities now available.

Customer Health Scores are comprised of a weighted range of data inputs specific to your customers and your business. The inputs might include NPS, survey results, overall usage of product, usage of the stickiest product features, growth of the customer’s usage, contact channel, etc. They will be discovered through detailed customer insight and business analytics. They will almost certainly change over time.

Collecting, analysing and weighting all the data needed to make predictions can be challenging. ‘Simpler’ CHSs are just descriptive while more robust analysis yields a much more valuable predictive health score i.e. if I do this, the customer is likely to do X and be worth Y.

Real time analysis displayed on living dashboards enables organisations to make proactive business decisions based on customer health score, customer value and predicted outcome (e.g. liability to churn, return on investment).

Philip Cooper